Professional Temporary Employment Outsourcing jkt2ww

Please click city listed below:

-

-

Taiwan Representative Office Setup jkt2tw.ro

-

Shanghai Temporary Employment Outsourcing jkt2cn.east

-

Xiamen Temporary Employment Outsourcing jkt2cn.south

-

Japan Temporary Employment Outsourcing jkt2jp

-

Korean Temporary Employment Outsourcing jkt2kr

-

Indonesia Temporary Employment Outsourcing jkt2vn

-

Philippine Temporary Employment Outsourcing jkt2ph

-

Thailand Temporary Employment Outsourcing jkt2th

-

Singapore Temporary Employment Outsourcing jkt2sg

-

India Employment outsourcing Services jkt2in

-

Indonesia Temporary Employment Outsourcing jkt2id

-

Australia Temporary Employment Outsourcing jkt2au

-

Germany Temporary Employment Outsourcing jkt2de

-

e-mail: jkt2ww@evershinecpa.com

or

Contact us by phone call during Jakarta Time 9:00-17 PM ( Taiwan 10 AM-18 PM).

For going-abroad cases, coordinator window will be

Project Manager Cindy Victoria Speak in Bahasa, English, and Chinese.

Whats App +886-989-808-249

wechatid: victoria141193

A professional employer organization (PEO) is a firm that provides a service under which an employer can outsource employee management tasks, such as employee benefits, payroll and workers’ compensation, recruiting, risk/safety management, and training and development. The PEO does this by hiring a client company’s employees, thus becoming their employer of record for tax purposes and insurance purposes. This practice is known as co-employment.

In co-employment, the PEO becomes the employer of record for tax purposes, filing paperwork under its own tax identification numbers. The client company continues to direct the employees’ day-to-day activities. PEOs charge a service fee for taking over the human resources and payroll functions of the client company: typically, this is from 3 to 15% of total gross payroll.[4] This fee is in addition to the normal employee overhead costs, such as the employer’s share of FICA, Medicare, and unemployment insurance withholding.

One service provided by a PEO is to secure workers’ compensation insurance coverage at a lower cost than client companies can obtain on an individual basis. Essentially, a PEO obtains workers’ compensation coverage for its clients by negotiating insurance coverage that covers not just the PEO, but also the client companies. This is allowed because, legally, the PEO is the employer of the workers at the client companies. PEOs can also offer basic levels of background & drug screening.

Using a PEO could potentially save the time and staff that would be used to prepare payroll and administer benefits plans, and may reduce legal liabilities or obligations to employees that it would otherwise have[5]. The client company may also be able to offer a better overall package of benefits, and thus attract more skilled employees. The PEO model is therefore attractive to small and mid-sized businesses and associations, and PEO marketing is typically directed toward this segment.[4]

PEOs can benefit companies differently. For example, a blue collar organization may see more value in workers’ compensation insurance and vice versa. A variation of a PEO model without co-employment is an administrative services organization.

Employment Outsourced Services

If your company doesn’t want to set up an WFOE (Wholly Foreign Owned Entity), but you will recruit employees temporarily or by project base, we suggest you adopt our Temporary Employment Outsourcing. It means Evershine will recruit your expatriate or local staff on behalf of your company. And then we will take care of all kinds of relevant local services including of payroll compliance and expenditure process.

Service Coverage:

*Work Permit Application recruited by Evershine

*ARC (Aliens Resident Certificate) Application

*Arranging Pick-up in International Airport

*Arranging hotel or renting residence

*Arranging Trading center or Office renting

*Arranging opening bank account

*Arranging Cell Phone or Car renting

*Payroll Compliance

*Arranging Employees’ expenditure

*Annual Personal Income Tax when an Expatriates stay in Taiwan over 183 Days in a year.

*Other local services

*If you want to use your own WFOE to execute payroll compliance, we will help you form it.

Service processes:

*Evershine will sign Labor Contract with your expatriates or local staff based on the term of your Employment Contract. At that same time, Evershine will sign Service Subcontract Agreement with your company.

*Evershine will apply work permit and ARC for your expatriates.

* Evershine will provide all relevant local service like airport pick-up, office arrangement, cell phone application, residence arrangement, bank account opening and medical insurance etc.

*Evershine will take care of payroll calculation and expenditure payment request of these expatriates and local staff. Then let you approve each payment and monthly payment sheet.

*Evershine will ask your company to pay us three-months salary as deposit fund before we pay salary and expenses to your expatriates and your local staff.

*Evershine will take care of wiring process to your Expatriates and Taiwan local staff.

*Evershine will take care of payroll compliance in Taiwan.

Advantages and disadvantages:

* Advantages: Adopting Evershine Temporary Employment Outsourcing, you need not to maintain a legal entity. You can quickly to assign a person. Of course you can withdraw your activities very easily.

*Disadvantages: Adopting Evershine Temporary Employment Outsourcing, when you pay us Expatriate cost including salary and its expenditures, it need to add up Value Added Tax according to tax regulations. That will increase your cost plus VAT rate when comparing with executing payroll compliance by your own WFOE.

*The conclusion is: When your employment is few people and short-term, you can adopt our Temporary Employment Outsourcing. And when your operation become stable and long-term, you need to set up your own WFOE . Remember we can provide payroll compliance services to you in both scenarios.

Contact Us:

Send an email to alisonchen@evershinecpa.com

or

Contact us by phone call during Jakarta Time 9:00-17 PM ( Taiwan 10 AM-18 PM).

For going-abroad cases, coordinator window will be

Project Manager Cindy Victoria Speak in Bahasa, English, and Chinese.

Whats App +886-989-808-249

wechatid: victoria141193

or

Headquarter Evershine BPO Service Corp.

6th Floor ,378, Chang Chung Rd, Taipei City, R.O.C.

Mr. Jerry Chu, well English speaker ,Graduated from USA Graduate School

E-mail: payroll.taiwan@evershinecpa.com

TEL: +886-2-27170515 #103

Mobile Phone +886-939-357-735

Additional Information

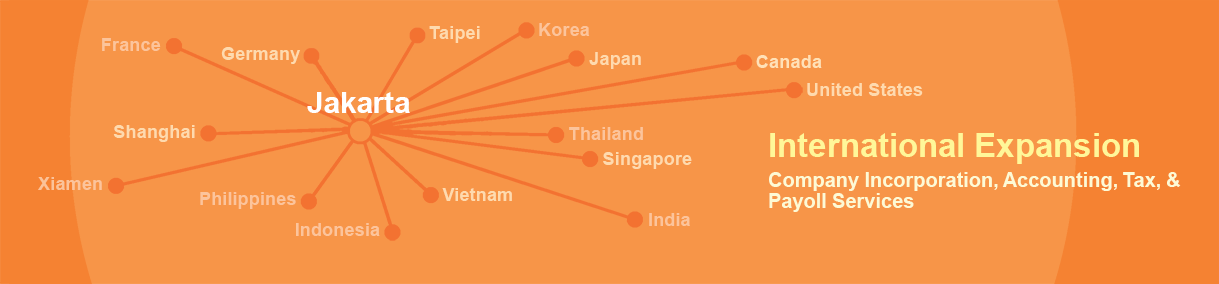

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shanghai,

Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo,

Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur,

Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt,

Paris, London, Amsterdam, Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us through HQ4jkt@evershinecpa.com

More services in more cities please click Sitemap